User Tag List

Results 1 to 13 of 13

11Likes

11Likes

Thread: Mortgage question-balance remaining?

-

Mon, Nov 10th, 2014, 10:58 PM #1Senior Canuck

- Join Date

- May 2008

- Location

- sechelt,b.c.

- Posts

- 739

- Likes Received

- 605

- Trading Score

- 7 (100%)

We are currently making double payments on our mortgage with the goal of having a very low amount remaining when the current term expires.I'm not really sure how close we are,and wanted someone a bit less math challenged to give me their opinion.How are we doing so far,and aprox. how much will we have left to pay by April 2018?We purchased the house in 2008,made lump sum payments and doubled up monthly,and have the option of lump sum payments till the end of the current term but would have to save to do so in any meaningful amount.The goal is to have it paid off in case I need to take early retirement or go on LTD.

Current Details Original Balance: $237,775.50 Outstanding Principal: $113,427.59 Original Amortization: 480 Actual Months Remaining: 110 Interest Details Interest Rate: 2.89% Accrued Interest: $133.83 Maturity Date: 03 Apr 2018 Mortgage Term: 60 months Mortgage Type: Fixed This thread is currently associated with: N/A

-

-

Tue, Nov 11th, 2014, 11:43 AM #2Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

Its Good you are trying to pay it off faster.

Your current interest rate of 2.89 % is very good. The rate is bound to go up in the coming years.

So by the time your MTG comes up for renewal the rates will be higher , much more than 2.89 % , but you will have a very low outstanding balance at that time, since you are paying it off faster

The Calculator below from CIBC might help you. It shows the calculations for extra payments..like lump sum , doubling the monthly MTG amt etc.

https://www.cibc.com/ca/mortgages/ca...e-payment.html

-

Tue, Nov 11th, 2014, 11:51 AM #3Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

Play around with the extra payments below , it should give you a rough idea about when your MTG will be paid off . You can change the interest rate to your 2.89 % & put your customized numbers & figures into it .

https://www.cibc.com/ca/mortgages/ca...e-payment.html

Extra Payments

One-Time Prepayment

$0

Annual Prepayment

$0

Increase Payment By

-

Tue, Nov 11th, 2014, 12:11 PM #4Smart Canuck

- Join Date

- Dec 2009

- Location

- Calgary

- Posts

- 3,737

- Likes Received

- 19634

- Trading Score

- 1 (100%)

Or just ask your bank when it will be paid off at the current rate you intend to pay it.

-

Tue, Nov 11th, 2014, 12:12 PM #5Smart Canuck

- Join Date

- May 2011

- Location

- Ottawa

- Posts

- 1,164

- Likes Received

- 1748

- Trading Score

- 1 (100%)

With the information you gave us, I calculated that your mortgage payment was around $836. If you keep that mortgage payment, and don't put any more money towards your mortgage, the balance left to pay at the end of April 2018 will be $89,203.

If you double up payments every month to $1672, the balance remaining will be 53,224.

It's not that difficult to calculate if you have a spredsheet program like Excel. You can also play with different scenarios by changing the payments.

Every mortgage payment is a combination of interest and principal. Using your current balance $113,427, and a mortgage payment of $836, calculate the interest, which is $113,427 X 0.0289 divided by 12 = $273.17. That interest is for one month. Then calculate the principal paid off that month: $836 - $273 = 563. Amount left on your mortgage is $113,427 - 563 = $112,864. Do the calculation again for the following months. Each month the interest amounts goes down and the principal goes up.

-

Tue, Nov 11th, 2014, 12:58 PM #6Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

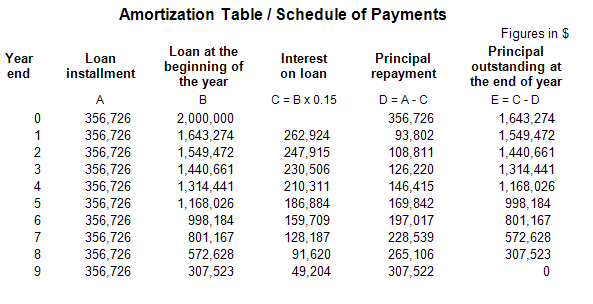

OP, when you make the extra payments, do you ask the lender to give you a revised amortization statement?

This should show you everything. This is free.

example

Last edited by Shwa Girl; Tue, Nov 11th, 2014 at 01:03 PM.

-

Tue, Nov 11th, 2014, 08:37 PM #7Senior Canuck

- Join Date

- May 2008

- Location

- sechelt,b.c.

- Posts

- 739

- Likes Received

- 605

- Trading Score

- 7 (100%)

We make our extra payments online.The regular payment is $1177.19 for principle and interest,we double up monthly for a total of $2354.38.I should have added that info,oops.Btw,we are first time home owners who had 10% down and had to get CMHC insurance and a 40 year amortization to swing the deal.We got a crappy interest rate on the first 5 years,but got a better rate at renewal by "threatening"to shop around.

-

Wed, Nov 12th, 2014, 09:08 AM #8Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

Since you have a 40 yr amortization , the first $ 1,177.19 regular payment you are making , very little from that is going towards the principle. I wouldn't be surprised if only $ 300 or $ 400 from that is going towards the principle & the rest $ 700 or $ 800 is going towards the interest only

But the second $ 1,177.19 ( extra payment ) you are making 100 % of that is going directly towards the principle . I think you will have very little left by the time 2018 comes around , so you should be fine

. I think you will have very little left by the time 2018 comes around , so you should be fine  . I am assuming you are doing this each & every month , and not just some months.

. I am assuming you are doing this each & every month , and not just some months.

You got your MTG in 2008 , I am assuming it was a 5 yr term then, with a 40 yr amortization. So when it came for renewal in 2013 , you should/could have gone for a lower amotization say 20 yrs or so , in addition to getting the better rate at that time. Maybe you did , I am not sure.

Lot of people make that mistake when their MTG term comes up for renewal say after 5 yrs or so , they don't bother to change the original amortization yrs & keep it the same.

-

Wed, Nov 12th, 2014, 11:25 AM #9Smart Canuck

- Join Date

- May 2011

- Location

- Ottawa

- Posts

- 1,164

- Likes Received

- 1748

- Trading Score

- 1 (100%)

-

Wed, Nov 12th, 2014, 02:58 PM #10Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

-

Thu, Nov 13th, 2014, 01:00 PM #11Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

That is just a screen shot.

If we can make an extra payment, we ask for a revised amortization table. That shows us how the future payments change. Payment to principal amount. Payment to the interest. What the last payment amount would be at the end of the mortgage term ( 2 year, 5 year, 10 year mortgage etc).

My point was that getting a revised amortization statement was free, every time you make an extra payment.

-

Tue, Nov 25th, 2014, 06:38 PM #12Smart Canuck

- Join Date

- Aug 2011

- Location

- Ontario

- Posts

- 1,005

- Likes Received

- 1216

- Trading Score

- 10 (100%)

I'm with scotiabank and I can do my own revised amortization schedule using online banking. I don't know how it is with other banks/their online banking.

-

Thu, Nov 27th, 2014, 01:45 PM #13

To be mathematically picky here, Canadian mortgages are specified to be "compounded semi-annually". At lower interest rates, it hardly makes any difference.

At current, the actual amount of interest is equal to $113,427 X ((1 + 0.0289 / 2) ^ (1/6) - 1) = $271.54. As you can see, your approximation is certainly close enough. It starts to make a difference in the 10% range.

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Send PM

Send PM