User Tag List

Results 16 to 30 of 38

-

Mon, Oct 22nd, 2012, 09:12 PM #16Smart Canuck

- Join Date

- May 2011

- Location

- Ottawa

- Posts

- 1,164

- Likes Received

- 1748

- Trading Score

- 1 (100%)

Making a bigger payment to a CC each month while leaving a savings' account empty is leaving yourself vulnerable to adding more debt (plus interest charges) when an emergency arises. Setting aside an emergency fund, which is true does delay the full repayment, is more sensible because, if an emergency arises, the debt isn't increased.

-

-

Mon, Oct 22nd, 2012, 10:35 PM #17

What about the interest charges being added up on your CC while you have money laying around in a savings account for that emergency which may never come?

I don't understand why people are so worried about "havin' money in da bank" when they have CC debt which is destroying them with interest. Yes you might have 500$ in your savings but really its NEGATIVE $500 because you owe $1000 to your card..

Now in the OP's case, he has $7500 in CC debt. I'm not sure what his interest rate is but i'm sure he will be better off paying it off rather quick.

OK lets say this "emergency" arises. What do? I know, Drop the CC payment to the minimum of lets just say for fun...2.5% which is approx. 200$ (and this number will drop fast paying 800$ to the balance) Use the remaining $600 + $100 he his setting aside for saving. If he needs more he can use room in the CC.

-What did we learn today? Its not wise to Borrow money with your Credit Card in order to have some emergency savings. The role of a credit card to be used in the event of this emergency we keep talking aboutJoin me in earning with Swagbucks http://www.swagbucks.com/refer/AForceNinja

-

Mon, Oct 22nd, 2012, 10:43 PM #18Canadian Genius

- Join Date

- Jul 2009

- Location

- Ontario

- Posts

- 5,555

- Likes Received

- 2433

- Trading Score

- 16 (100%)

I use my credit card to earn credit. I only put what I can pay off every month on it. But every month I put something on it. They just keep raising the credit limit. I had to ask that they leave it at 12000. Not that I would ever need that amount but just in case

This month I will put all the gas for the car on it. It is already in my budget

This month I will put all the gas for the car on it. It is already in my budget

-

Tue, Oct 23rd, 2012, 09:21 AM #19Men Coupon Too!

- Join Date

- Jun 2011

- Location

- Kelowna

- Posts

- 190

- Likes Received

- 132

- Trading Score

- 1 (100%)

To be honest, I agree with AforceNinja... I couldn't stand having savings earning 1-5% MAX while my CC is costing me 19.9%... so I withdrew my TFSA on Thursday & will apply that to my CC"s... (It was only $320 anyway) but every bit helps!

What I'm wondering now is, how long does the TFSA take to go into my account? It's tuesday now and nothing has happened yet :s

So far so good on the budget!!

-

Tue, Oct 23rd, 2012, 09:35 AM #20

It shouldnt take more than 2-3 days...usually

I'm glad you used your head to figure out the logic instead of listening to financial advisers which make no sense most of the timeJoin me in earning with Swagbucks http://www.swagbucks.com/refer/AForceNinja

-

Tue, Oct 23rd, 2012, 01:14 PM #21Men Coupon Too!

- Join Date

- Jun 2011

- Location

- Kelowna

- Posts

- 190

- Likes Received

- 132

- Trading Score

- 1 (100%)

What made it even easier, is knowing that once I am caught up, I will be increasing my contributions to TFSA & RRSP to $100/month each.. minimum.. I am currently doing $25/month to each!

So it won't take more than 3 months to re-contribute what I've taken out...

-

Tue, Oct 23rd, 2012, 01:44 PM #22

Just make sure you dont go over your TFSA contribution room for this year, wait till January if that does happen

Join me in earning with Swagbucks http://www.swagbucks.com/refer/AForceNinja

-

Tue, Oct 23rd, 2012, 01:52 PM #23Men Coupon Too!

- Join Date

- Jun 2011

- Location

- Kelowna

- Posts

- 190

- Likes Received

- 132

- Trading Score

- 1 (100%)

Isn't the contribution limit $5000?

I've only put in $225 I think... unless you mean something else?

To hit the contribution limit I'd have to put in over $400/month, correct?

-

Tue, Oct 23rd, 2012, 02:25 PM #24

Ahh yea the part where you wrote $230 slipped my mind.

Yes its 5000$ per year that you've had your TFSA so you should be fineJoin me in earning with Swagbucks http://www.swagbucks.com/refer/AForceNinja

-

Tue, Dec 4th, 2012, 06:51 PM #25Men Coupon Too!

- Join Date

- Jun 2011

- Location

- Kelowna

- Posts

- 190

- Likes Received

- 132

- Trading Score

- 1 (100%)

A little update, I've been using YNAB instead of Gail's approach since the beginning of November, and I can't believe the progress I've made already!! We managed to get $400 further out of overdraft, paid $1100 to credit cards, saved money for Christmas, paid off a bunch of little things, got caught up on bills, etc... All in one month!!!

Needless to say, I am over the moon esctatic about YNAB (You Need A Budget) and what it does for personal finance, I wrote a separate thread about it:

http://forum.smartcanucks.ca/331172-...ftware-canada/

-

Wed, Dec 5th, 2012, 12:37 PM #26Smart Canuck

- Join Date

- May 2011

- Location

- Ottawa

- Posts

- 1,164

- Likes Received

- 1748

- Trading Score

- 1 (100%)

GoStumpy, that's great that you were able to find a tool that helps you. Heading over to read your review right now.

-

Tue, Jan 22nd, 2013, 09:24 PM #27Men Coupon Too!

- Join Date

- Jun 2011

- Location

- Kelowna

- Posts

- 190

- Likes Received

- 132

- Trading Score

- 1 (100%)

Well it's been over a month since an update, and boy oh boy am I still hooked

I've managed to pay for Christmas in cash, spend too much money at restaurants, yet still pay more debt than ever before & my bank account continues to grow! I can't believe it can be this easy, and enjoyable! We feel like we're spending smart, not cutting back...

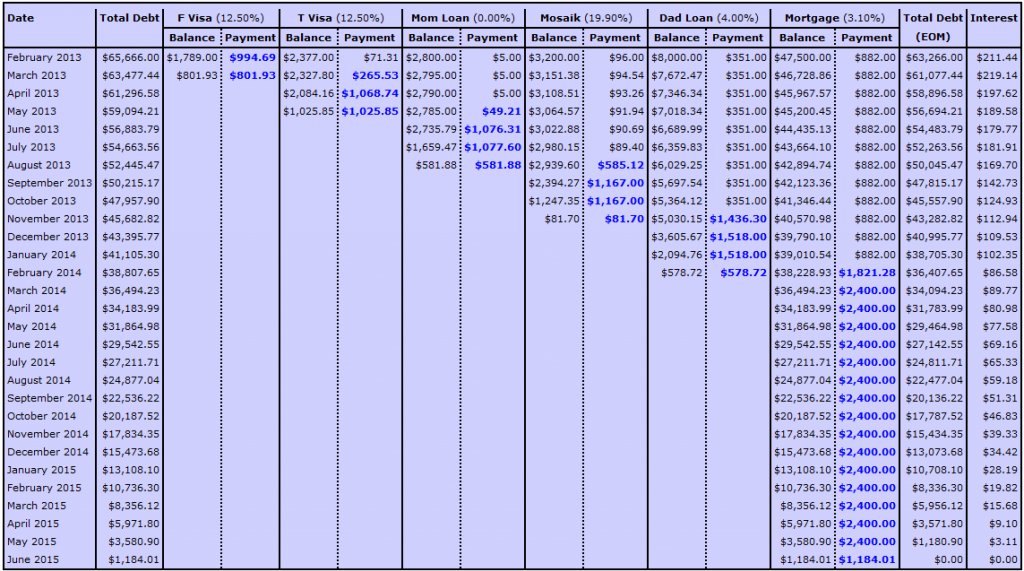

This month alone I've put $700 towards my $1k mini emergency fund, it will be fully funded on my next paycheque. Then I will begin agressively attacking my debts with the Debt Snowball method... Here is my repayment schedule:

This means I can be completely debt-free including the mortgage by summer 2015!! That's the year after next!!!!!!!

Am I getting across how excited I am????

www.youneedynab.com

www.youneedynab.com

- Stop dreading the word 'Budget', and start enjoying budgeting! -

-

Wed, Jan 23rd, 2013, 12:03 AM #28momof5boys

- Join Date

- Sep 2010

- Location

- Western Canada

- Posts

- 2,611

- Likes Received

- 3514

- Trading Score

- 509 (100%)

GoStumpy....love how you have a plan!

-

Wed, Jan 23rd, 2013, 01:19 PM #29CaNewbie

- Join Date

- Jul 2011

- Location

- northern ontario

- Posts

- 75

- Likes Received

- 133

- Trading Score

- 13 (100%)

I totally agree! I was fortunate to have a line of credit at 4.5%. I paid off all my credit cards with that and froze my cards in a block of ice in the freezer. I will never, ever charge them up again. It took almost three years to pay off that line of credit but its done and now we stick to a very strict budget. If we don't have the money, we do without. No more huge Christmas splurges, or vacations unless we have saved up for them first.

-

Wed, Jan 23rd, 2013, 04:46 PM #30Oppi Fjellet

- Join Date

- Dec 2011

- Location

- Middle of nowhere, ON

- Posts

- 1,276

- Likes Received

- 32

- Trading Score

- 30 (100%)

I have made bad choices when it comes to saving and budgeting.. both of my parents are excellent at it and have taught me well but I have a lot of debt so I have no suggestions. Would you all agree that it would be best to pay off debt before saving? I find it extremely hard to save - aside from couponing - when I have Credit card bills, student loans to pay back. What have you more seasoned folks done when creating a budget and how have you stuck to it?

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

10Likes

10Likes

Send PM

Send PM