User Tag List

View Poll Results: In 2013, would you BUY or would you RENT?

- Voters

- 32. You may not vote on this poll

-

Better to Buy

21 65.63% -

Better to Rent

8 25.00% -

Don't know

3 9.38%

Multiple Choice Poll.

Results 16 to 30 of 102

-

Sat, May 18th, 2013, 09:07 PM #16Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

Yes, a lot of people would not spend that much on a house. The Prof. at McMaster has business/finance students in Hamilton and assumes that they would be looking for a house in Hamilton, around that price range. This prof does this every year. I think the students like this assignment.

-

-

Sun, May 19th, 2013, 01:16 AM #17Canadian Genius

- Join Date

- Apr 2011

- Location

- West Vancouver, BC

- Posts

- 7,008

- Likes Received

- 11041

- Trading Score

- 368 (100%)

Location plays into it also. On the westcoast housing is very expensive. If you rent, when you retire, you probably couldn't afford to do so as rents are very high. I am planning on selling when I think it's right and then live off the proceeds. The proceeds will be part of my retirement fund. I have had money in investments and they have not appreciated like all the investors claimed they would. Real estate on the other hand has appreciated very well in this area and probably will continue to do so.

-

Sun, May 19th, 2013, 11:25 PM #18Smart Canuck

- Join Date

- May 2009

- Location

- Winnipeg

- Posts

- 1,922

- Likes Received

- 2075

- Trading Score

- 39 (100%)

I think it depends what you want, too. In Winnipeg, a $400,000 house is a nice house. Ours is in that range, and our monthly mortgage payment is about $1300. My late grandfather's wife pays that for an apartment, where she lives alone. $1300 wouldn't rent much of a house, and it's unlikely to find a close-to-2000 sq. foot long-term house rental in a nice area of Winnipeg. Those that might be available are more likely to belong to families away for a year or two. Yes, we're paying property tax and utilities, but we also have a finished basement and a backyard for our family, and we're gaining equity. We can park our cars in our garage. Getting into the market when we did made owning a better idea... starting in 2013, I'm not so sure, as prices are so high at this point.

I think the calculation also assumes that the renter would have $100,000 to invest (at age 25, no less!), and I'm not sure that most renters do! I started teaching in 1999 when I was 21, and I was making somewhere around $2,000 a month for the first few years (my salary was paid over 10 months for the first two years and divided over 12 months when I got a permanent contract, so the monthly number stayed about the same... I wouldn't even have taken home $100,000 total by age 25!)

It depends on what you want and what your priorities are, I guess... if you're happy renting and you enjoy saving and investing in order to get to some magic number by 65, great. Having a good pension as well as money put away in RRSPs, I'm not enormously worried about my retirement years. I know some people are "experience" people who like to spend most of their spare money on trips and things. My brother spends his money on "toys" like a boat, a trailer at a campsite, motorcycles, and snowmobiles, and he lives in a very small house. I enjoy saving money, but I also enjoy having nice things that I enjoy every day. Funny -- I mentioned at the lunch table at work that my husband and I had spent the bulk of our airmiles (about 8000) on a new Weber barbecue. One deeply-tanned woman gasped and said, "You could have bought an airline ticket to Hawaii with that!!!" I'd much rather have a barbecue that we can use for years!

-

Mon, May 20th, 2013, 10:27 AM #19Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

Yes, the scenario assumes a lot.

About the $100,000 to invest, the Prof used his finance students as an example and they may be in the category of making more than a starting teacher's salary, depending on where they work. They may not have $100,000 in the first year, but the same goes for the potential home owner saving the $100,000 down payment. The renter can save up the $100,000 in higher interest paying investments. The potential home owner saving $100,000 would probably put the money in safe investments that pay lower interest.

-

Mon, May 20th, 2013, 11:40 AM #20

I tend to view analyses performed by "experts" with a large grain of salt. Said "experts" tend to be people who are in a position to make money if you decide one way or the other based on their advice.

Bottom line right now, houses are expensive - reaaaaaally expensive. If you include all of the costs of owning (many "experts" tend to ignore property tax, land transfer tax (double if you are in Toronto), maintenance, increased insurance, real estate commissions to sell, legal costs to buy/sell, the lost return on the $100K down payment, and most totally ignore the possibility for interest rates to increase), then you can make a fair comparison.

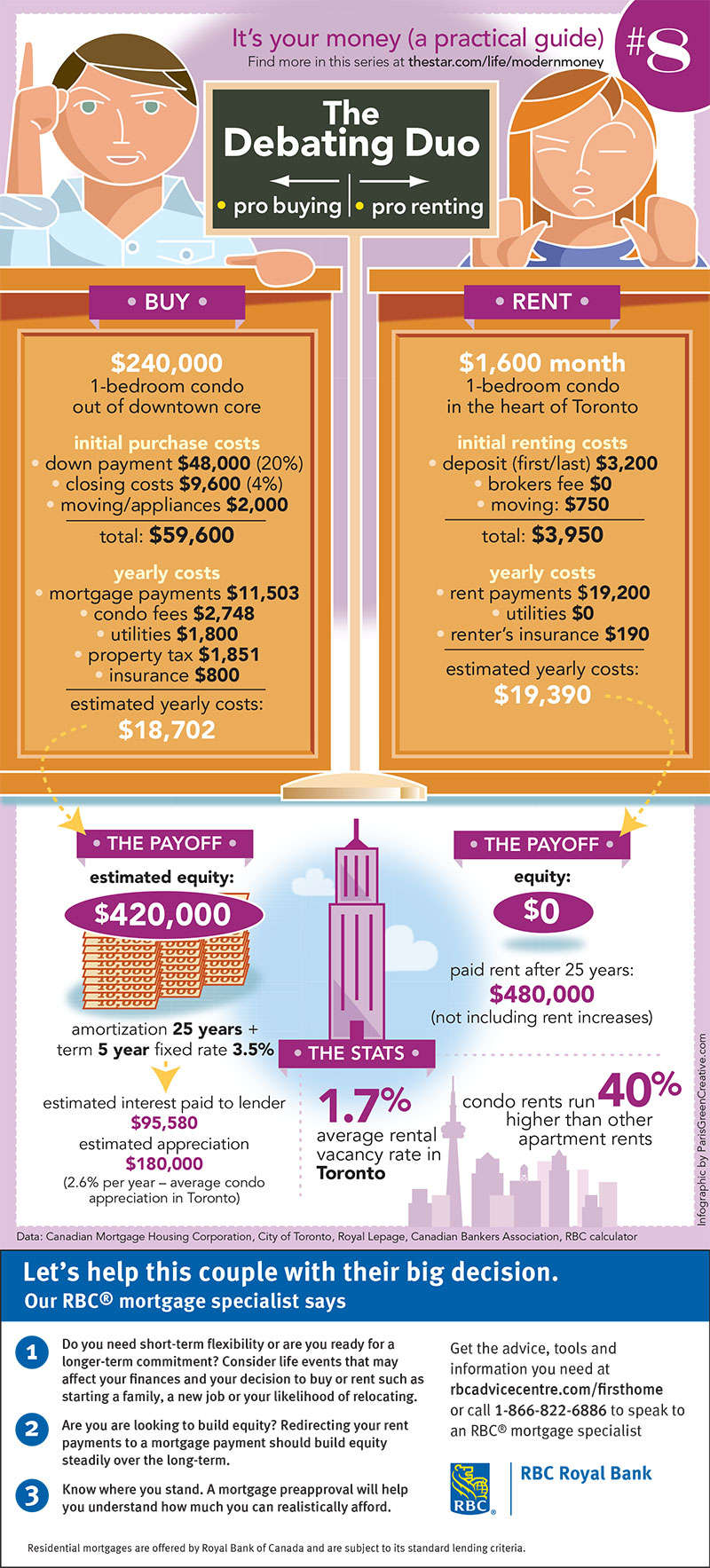

Check out a recent "analysis" by RBC - it falls short of the truth by a very large distance:

I won't pretend to be able to make a judgement for everyone. But, if you expect to live in your house for under 10 years (as I do), then it isn't even close. For me, renting wins **hands down**. I have been hit with the reaction that I can't possibly be right more times than I can count. But I have done the numbers dozens of times, I am (very) mathematically literate, and I am a nitpicker to the extreme when it comes to this kind of analysis.

To do a real analysis, one needs to find the best possible rental, not just an average. I am darned cheap on everything, including housing. My housing costs are roughly one half what they would be if I owned the exact same building. I am not paying my landlord's mortgage, he is subsidizing my living. He is losing money each and every month of every single unit in this place. Thing is, he doesn't even realize it, but he comes from a rich family, and keeps pouring money into the place.

Much of the analysis also depends on what house prices will be like in the future. Here, I am in what has been a very minority camp - I believe that house prices will be declining. Every number that I have produced is absolutely screaming this, except for a single one - mortgage carrying cost versus house cost, and this one is just marginal. But this one is not in the hugely overpriced category due to historically unprecedented low interest rates. Tell a young houseowner now about how I was ecstatic to get a 12+% mortgage after rates were north of 20% for a while, and they look at you like you are telling fairy tales.

Sure, I don't expect those kinds of rates again soon, but even a return to the historical average of 6-7% rates would hammer house prices.

In short, if you expect to live in your house for 25 years (and how many people actually do that), OR you are willing to spend the extra money for owning a house, then by all means, buy one. But only if its value represents a smallish fraction of your total net worth.

Sorry for the rant, I am not implying that your post is biased, I am just sick to tears of reading "expert" analysis based on poor assumptions that misses major expenses of owning. This is a huge disservice to all who depend on said experts for their advice.

-

Mon, May 20th, 2013, 03:03 PM #21Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

Nice to see you posting in the Finance section again. Thanks for your thoughts, especially the RBC info.

Umm, I think that you are in agreement with the McMaster prof, somewhat. You are renting. You crunched the numbers for yourself. You arrived at the same conclusion -- in 2013, for a person starting out and making the decision to rent or to save to buy a home, renting and investing is the best option.

About experts -- someone once said an expert is actually a farmer - 'a man outstanding in his field'

Last edited by Shwa Girl; Mon, May 20th, 2013 at 03:04 PM.

-

Mon, May 20th, 2013, 03:23 PM #22

Thanks for the positive feedback.

Just to point out in the RBC ad, I would like to bring everybody's attention to the first flaw of a number contained therein. They compare renting in downtown to owning in the suburbs. Talk about your apples and oranges. Why not compare owning a cardboard box to renting the Taj Mahal then?

I hadn't had a chance to read your answer when I was cooking up the post in my head, so I missed your post. That's pretty well the first time that I have seen "analysis" come up with that answer, hence my diatribe. People have been handed bad advice from supposed experts for so long, it is increasingly difficult to convince them that they have been lied to in the first place.

-

Mon, May 20th, 2013, 04:15 PM #23Canadian Genius

- Join Date

- Jan 2009

- Location

- Somewhere over the rainbow

- Posts

- 6,751

- Likes Received

- 4625

- Trading Score

- 86 (100%)

Would rent on a $400,000 house really only be $1500 a month? We rent the place we are in now and bought it from our landlord last year. We paid $2100/mth rent and it's a $300,000 house. In Ottawa we paid $1100/mth rent and the places sold for $200,000 or so. Seems to me the rent would be much higher than $1500.

-

Mon, May 20th, 2013, 05:54 PM #24Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

-

Mon, May 20th, 2013, 06:03 PM #25Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

I guess it's living the Canadian dream. House with white picket fence. Even Home Depot's commercials for the May 24th long weekend has people getting their gardens ready for the summer.

By the way, renters can get into gardening too -- community gardens where for a small fee, they can work their own garden plot in their communities.

-

Mon, May 20th, 2013, 06:33 PM #26Canadian Genius

- Join Date

- Jan 2009

- Location

- Somewhere over the rainbow

- Posts

- 6,751

- Likes Received

- 4625

- Trading Score

- 86 (100%)

In order for the scenario to work properly the prof should have compared the same dwelling. I'd be surprised if anywhere in Canada rent on a house that is valued at $400,000 would be so low.

Really, when landlords rent out a place, they aren't giving it away. They are covering their mortgage and costs, ect... Landlords are in it for the money, not the goodness of their hearts.

-

Mon, May 20th, 2013, 06:37 PM #27

-

Mon, May 20th, 2013, 08:02 PM #28Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

For the most part, I agree - landlords tend to place rents higher. However, I know a landlord who is so happy with his tenant, he is reluctant to raise the rent too high --fearing the good tenant would leave. The tenant keeps the place really well, always pays on time and has been there a few years - no troubles for the landlord.

-

Mon, May 20th, 2013, 09:28 PM #29Smart Canuck

- Join Date

- May 2009

- Location

- Winnipeg

- Posts

- 1,922

- Likes Received

- 2075

- Trading Score

- 39 (100%)

I imagine that there are situations where some landlords are renting homes just to cover expenses because they want to hang onto a house they aren't currently living in, or they want to gain equity in the house as an investment and are hoping for house prices to rise. For some people, renting an individual home may be a way to keep that house (maybe it's one that was in the family at some point?) and a way to have something to sell for cash when they retire. I can see how some might want to keep a good tenant in this kind of scenario, even if they aren't making much "profit" month to month.

-

Mon, May 20th, 2013, 09:46 PM #30Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

105Likes

105Likes

Send PM

Send PM