User Tag List

View Poll Results: I'm voting

- Voters

- 53. You may not vote on this poll

-

NDP

17 32.08% -

Conservative

15 28.30% -

Liberal

9 16.98% -

Bloq Quebecois

1 1.89% -

Green

0 0% -

Other/Haven't decided yet

11 20.75%

Results 1,126 to 1,140 of 1837

-

Sun, Oct 11th, 2015, 02:32 PM #1126Canadian Genius

- Join Date

- Mar 2010

- Location

- ON

- Posts

- 6,071

- Likes Received

- 13059

- Trading Score

- 51 (100%)

.

Last edited by lecale; Thu, Oct 29th, 2015 at 11:42 AM.

-

-

Sun, Oct 11th, 2015, 03:19 PM #1127Canadian Genius

- Join Date

- Oct 2007

- Location

- toronto, ontario

- Age

- 34

- Posts

- 5,946

- Likes Received

- 4230

- Trading Score

- 0 (0%)

I just voted

http://www.amazon.com/gp/cdp/member-...stRecentReview

My amazon reviews, check them out sometime!

-

Sun, Oct 11th, 2015, 03:38 PM #1128Banned

- Join Date

- Aug 2015

- Location

- Here and There

- Posts

- 2,098

- Likes Received

- 2704

- Trading Score

- 0 (0%)

Strategy time: What the Liberals need to do to win

-

Sun, Oct 11th, 2015, 03:53 PM #1129Canadian Genius

- Join Date

- Oct 2007

- Location

- toronto, ontario

- Age

- 34

- Posts

- 5,946

- Likes Received

- 4230

- Trading Score

- 0 (0%)

Ive given up on trying to predict an outcome...there is too much contradicting information out there

http://www.amazon.com/gp/cdp/member-...stRecentReview

My amazon reviews, check them out sometime!

-

Sun, Oct 11th, 2015, 04:27 PM #1130Canadian Genius

- Join Date

- Oct 2007

- Location

- toronto, ontario

- Age

- 34

- Posts

- 5,946

- Likes Received

- 4230

- Trading Score

- 0 (0%)

this election is way too hard to predict because of all the false and contradictory info out there

http://www.amazon.com/gp/cdp/member-...stRecentReview

My amazon reviews, check them out sometime!

-

Sun, Oct 11th, 2015, 05:12 PM #1131Canadian Guru

- Join Date

- May 2010

- Location

- Cape Breton

- Age

- 53

- Posts

- 10,163

- Likes Received

- 11367

- Trading Score

- 30 (100%)

-

Sun, Oct 11th, 2015, 05:33 PM #1132

-

Sun, Oct 11th, 2015, 05:36 PM #1133Banned

- Join Date

- Aug 2015

- Location

- Here and There

- Posts

- 2,098

- Likes Received

- 2704

- Trading Score

- 0 (0%)

^ it seems so

Last edited by beachdown; Sun, Oct 11th, 2015 at 05:37 PM.

-

Sun, Oct 11th, 2015, 06:00 PM #1134Canadian Genius

- Join Date

- Oct 2007

- Location

- toronto, ontario

- Age

- 34

- Posts

- 5,946

- Likes Received

- 4230

- Trading Score

- 0 (0%)

http://myemail.constantcontact.com/C...id=9eDoc6hoFjc

A CPA, a Tax Auditor, and the CBC Walk into a Bar...October 8, 2015

By Cory G. Litzenberger, CPA, CMA, CFP®, C.MgrIt must be a joke, because it certainly was not journalism.

As many of you know, nothing angers me more than false news reporting that make you think something that is not true. So when my own designation and profession come under attack, you can bet I won't be standing on the sidelines.

This isn't the first time I've had to call out the CBC on misleading stories: remember the Child Tax Credit vs Child Tax Benefit error which made it sound like families were going to lose thousands of dollars that they currently were getting? We actually had phone calls coming to our office from Newfoundland on this one after our newsletter went viral on Facebook. If you don't remember, go to this link for the commentary. Oh, and CBC did issue a retraction one day after we published our newsletter.

Now this one needs to go viral as well.

In pure election click-bait, the CBC headline for this article reads: " Exclusive: Harper government partnered with industry group fighting CRA over KPMG case - Minister championed 'collaboration' with CPA Canada as organization was battling tax investigators" and the link is here, but I warn you, it is completely misleading.

The CBC is trying to make a link on different things that are happening at the same time, but trying to make it look like some conspiracy and that Harper is the devil. Harper has nothing to do with it, but that's another story.

First some background.

Ever since I became an accountant the three governing bodies of CA, CMA, and CGA were talking about merging. Finally, after decades of talk, it finally happened. We are now under the banner of Chartered Professional Accountants (CPAs).

Why the merger?

Accountants in Canada were not getting enough say at the international tables because we were too fragmented. Canada follows International Financial Reporting Standards (IFRS) for its accounting regulations. The United States is now the only country that does not. When the rules were brought to Canada in 2011, we didn't like some of the changes, but our voice was not heard. It was only after the implementation of IFRS that accountants REALLY started to unite in Canada.

We also didn't like the fact that everyone and their dog can call themselves an accountant, so we needed to unite the brand, and hopefully eventually push for regulations on the word "accountant."

So we merged, now what?

We began forging relationships with our colleagues on the other side of the fence at the CRA, many of which are also CPAs. Having worked there myself, I can speak first hand about how it is not an us vs them relationship. We both have jobs to do. Sometimes we disagree, but that's how our system works.

Being the largest group of tax preparers in Canada, we wanted to share information with the CRA on what we are seeing on our side of the fence to improve the system, and they thought it would be beneficial to do the same. The goal is to improve the overall system for all taxpayers, target the problem ones, etc.

As a result, a "framework agreement" was signed. All it was saying was that the CRA would have a representative and CPAs would send a representative that would share non-confidential summary information on issues on both sides of the fence. This was to help identify issues in, for example, Scientific Research & Experimental Development (SRED). On our side of the fence we used to send binders and binders of information for a SRED claim, because it needed to be "complete." The CRA said STOP sending us this, because it was too much, and they don't need all of it.

This line of communication led to the development of a simple form to fill out, and when an auditor looks at it, they then will request information that they want at that time. It was a win/win. Clients didn't have to pay us for putting together massive packages, and the CRA didn't get bombarded with stuff they didn't need in the first place.

That success led to the idea of taking it into other areas like compliance (filing/audit), service (call centres/online), training (both for auditors and for tax filers alike), etc.

As you can see in the article, it has nothing to do with Harper at all. The lobbying meeting between Harper and CPA Canada is more likely to do with protecting the integrity of our tax and financial system than anything.

So now that we know the intent of the agreement, what does the KPMG court case have to do with anything?

Anyone who understands law knows that an "intervenor" at Federal Court is not coming to the defence's aid, in fact, could even be the opposite or both (yes both if we think both are wrong).

An intervenor is a interested party that VOLUNTARILY enters a pending court action because of a personal stake. In other words, CPA Canada, representing EVERY CPA in Canada was wanting to be heard on an issue that the court was reviewing. The outcome of the case before Federal Court may have broader implications than the specific case before them, and so should be taken into account in any ruling (for or against) the parties involved. Federal Court rulings carry more clout than lower court rulings, so it is not unusual for accountants to want a say if it has broad reaching implications.

I sit on the CPA Alberta Tax Working Group. A small group of about a dozen tax nerd CPAs like me across Alberta that provide advice to the executive of CPA Alberta. Part of the reason CPAs wanted to intervene in this case is quite technical and comes down to the overall integrity of the tax system.

CPA Canada has been lobbying for a streamlined version of priviledged communications between tax accountants and clients... that's it. While I do not know the specifics of KPMG's dealings, the reality is that the CPA was not asking to intervene in the case for KPMG's benefit. Rather, the bigger picture position for ALL accountants of confidential communications with clients.

Accountants like myself hear more confessions than a catholic priest, and yet we currently can be called to testify against our own clients for any advice we give.

For example, if you came to me and asked "what are my tax risks with the following options" that communication is now fair game to the CRA. That makes no sense. How can ANY taxpayer make an informed decision on taxation if I don't say the pros and cons of each?

It has nothing to do with offshore or aggressive tax schemes or illegal acts. It has to do with protecting the integrity of the tax system by allowing a taxpayer to conduct conversations in a confidential manner with their advisors. If I can't give you confidential advice, what is the use of having an accountant?

The CPA asked to intervene, because as an accountant, I should not have to hand over my entire customer list just so the CRA can go on a fishing expedition. The CBC didn't hand over the list of names that THEY got because it "protects their source" but accounting firms should hand over client lists?

The Income Tax Act states under 231.2(2) that "the Minister" (CRA) shall not impose on any person a requirement to provide information or any document relating to one or more UNNAMED persons unless the Minister first obtains the authorization of a judge.

KPMG is fighting the lower courts ruling (which is their right) at federal court feeling that the CRA did not meet the burden of proof under 231.2(3) to compel them to release information that is their client list.

The CRA also is coming back under 231.7(1) for a compliance order to force KPMG to release the information (which is their right).

231.7(1) then brings up the issue "unless it is privileged."

One of the issues is whether correspondence between an accountant and client is privileged if the correspondence is occuring as a result of lawyer involvement or in "contemplation of litigation". For example: "If we take this position on your filings, we may have to take it to tax court" could be considered to be in conteplation of litigation.

CPA Canada wanted in because they are trying to say that taxation matters should be confidential, and accountants should not be called to testify on the very clients they were being paid to assist on "what was discussed".

It is such a complex issue but the CBC is trying to make it sound like some big conspiracy coming from Harper, the CPA, and back room deals with the CRA. Do they forget that many of the CRA staff are ALSO CPAs?

Oh the conspiracy! (note: sarcasm)

The partnership was a long time in the making. We are trying to do our jobs. I used to work for CRA. I have friends that still do. It isn't an US vs THEM (usually). We just are doing our jobs, and sometimes we will disagree on interpretations of tax law, that's how the system works.

We are all participating members of the Canadian Tax Foundation along with tax lawyers and the department of justice, who are commonly on opposite sides of a case.

The conspiracy thickens! (yes, sarcasm again)

The purpose of collaboration is not back-room deals like the CBC hints at. The purpose is to improve the ability for tax filers and tax auditors to share what they are seeing on their sides of the fence.

For example, if we are seeing high problems with a form, (one look at the wording of T2 Schedule 88 will show you what I mean), it allows us a channel for our membership to bring up the issue to them.

Conversely, if the CRA says that they are seeing many compliance issues with say "vehicle logs" then it allows us to take that back to our clients and make sure they are keeping the proper records. Reminder: we have free logs at the office for those clients that need some.

As it says right in the agreement on the CBC's page which every CPA in Canada got a copy of as well, it is NOT a decision making group. It is a consultation group.

So now that you are informed of the CPA, the CR A, and their positions, what part of that is even remotely close to the CBC headline or the picture the article tries to paint?http://www.amazon.com/gp/cdp/member-...stRecentReview

My amazon reviews, check them out sometime!

-

Sun, Oct 11th, 2015, 06:05 PM #1135Canadian Genius

- Join Date

- Oct 2007

- Location

- toronto, ontario

- Age

- 34

- Posts

- 5,946

- Likes Received

- 4230

- Trading Score

- 0 (0%)

http://www.ekospolitics.com/index.ph...tie-continues/

Ekos continues to put the tories in the leadhttp://www.amazon.com/gp/cdp/member-...stRecentReview

My amazon reviews, check them out sometime!

-

Sun, Oct 11th, 2015, 06:15 PM #1136Mastermind

- Join Date

- Oct 2008

- Location

- SK

- Posts

- 118,045

- Likes Received

- 147799

- Trading Score

- 29 (100%)

-

Sun, Oct 11th, 2015, 06:23 PM #1137

-

Sun, Oct 11th, 2015, 06:24 PM #1138Canadian Genius

- Join Date

- Oct 2007

- Location

- toronto, ontario

- Age

- 34

- Posts

- 5,946

- Likes Received

- 4230

- Trading Score

- 0 (0%)

http://www.amazon.com/gp/cdp/member-...stRecentReview

My amazon reviews, check them out sometime!

-

Sun, Oct 11th, 2015, 06:25 PM #1139Canadian Guru

- Join Date

- May 2010

- Location

- Cape Breton

- Age

- 53

- Posts

- 10,163

- Likes Received

- 11367

- Trading Score

- 30 (100%)

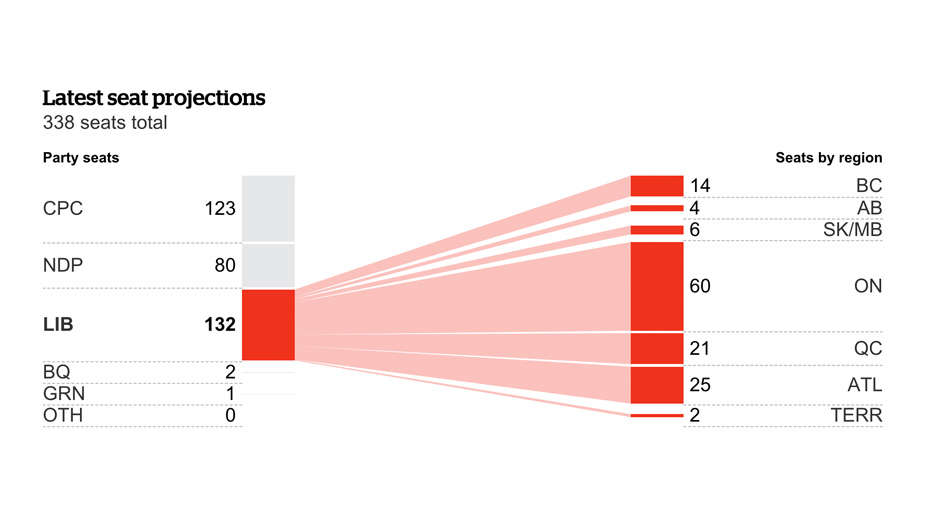

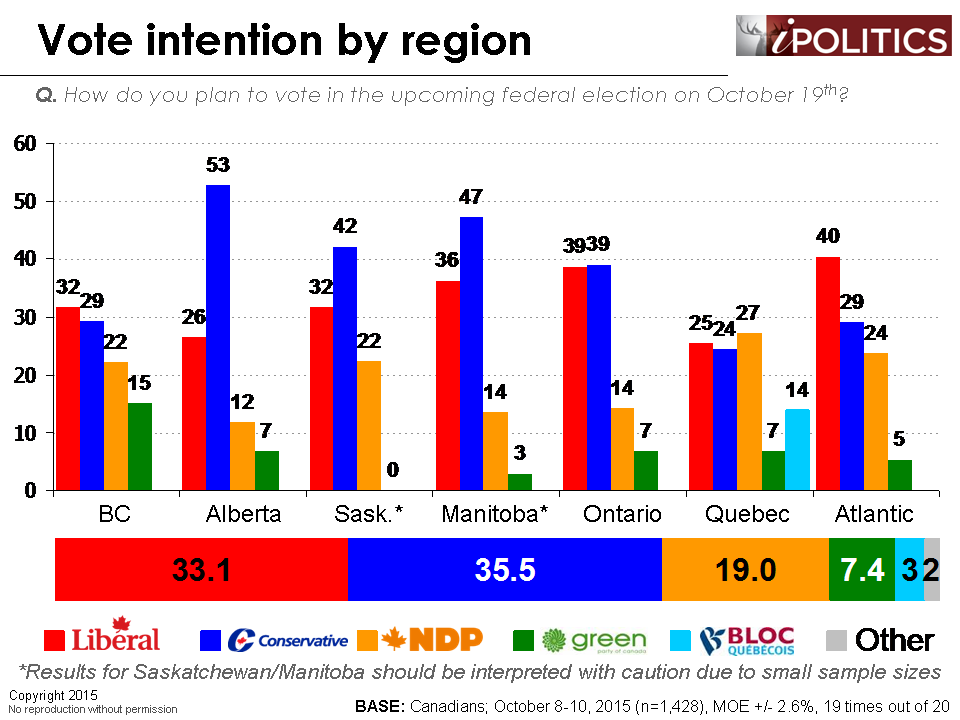

Regional breakdown according to EKOS

From the article:

That would be hilarious - so many heads would explode!The public do not believe that either the Conservatives or the Liberals will win a majority, but Canadians will be apoplectic if Stephen Harper wins another majority.

-

Sun, Oct 11th, 2015, 06:39 PM #1140Canadian Genius

- Join Date

- Oct 2007

- Location

- toronto, ontario

- Age

- 34

- Posts

- 5,946

- Likes Received

- 4230

- Trading Score

- 0 (0%)

http://www.amazon.com/gp/cdp/member-...stRecentReview

My amazon reviews, check them out sometime!

Thread Information

Users Browsing this Thread

There are currently 2 users browsing this thread. (0 members and 2 guests)

3751Likes

3751Likes Send PM

Send PM