User Tag List

Results 1 to 15 of 29

Thread: 2023 Benefit Payment Dates

-

Mon, Dec 12th, 2022, 12:56 PM #1Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,288

- Likes Received

- 7354

- Trading Score

- 0 (0%)

Expired on: Mon, Jan 1st, 2024While the dates are not yet available on the Canada Revenue Agency site, it's a good time to remind Smart Canucks that on January 1, 2023 you may need to update your own personal payroll information on the TD1 forms at work via whoever does payroll or the payroll department. You could even print that form off the CRA site and prepare it at home to sign at the workplace in 2023. Make a copy for your own records too.

It looks like CRA is encouraging taxpayers to print off forms from their site but 2023 TD1s are not yet posted. Search Canada Revenue Agency - Canada.ca

Why? You may have a change in marital/common-law status, have changes to your minor dependents in your household, personal tax credits change based on age (once you turn 18 or 65-impacts your CPP contributions from your pays), have tuition credit claims or pension credit amount claims, or you moved to a different province where now you can claim a senior transit tax credit (Ontario, must be 65+ and have a registered transit card to make the claim) or have a job that allows you to claim a work-related supplies expense where you have to provide work clothes or school supplies, for example, that your employer does not provide but makes as a condition of your employment. And if your job suddenly provides or stops any medical coverage, your medical expenses that you claim will affect your non-refundable tax credit for medical costs not covered by an insurance plan.

Yes, if you moved prior to December 31 for residency reasons, you may even have a different tax package to use to reflect the changes in provincial or territorial tax benefits and credits.

Add the review to your late 2022/early January 2023 planner/agenda/smartphone calendar! This thread is currently associated with: Via Rail

This thread is currently associated with: Via RailLast edited by Ciel21; Mon, Dec 12th, 2022 at 12:59 PM.

"This is the Way." The Mandalorian

-

-

Sun, Dec 18th, 2022, 06:20 PM #2Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,288

- Likes Received

- 7354

- Trading Score

- 0 (0%)

Canada Pension Plan/Old Age Security

- January 27, 2023

- February 24, 2023

- March 29, 2023

- April 26, 2023

- May 29, 2023

- June 28, 2023

- July 27, 2023

- August 29, 2023

- September 27, 2023

- October 27, 2023

- November 28, 2023

- December 20, 2023

Goods & Services Tax Credit/Harmonized Sales Tax Credit

- January 5, 2023

- April 5, 2023

- July 5, 2023

- October 5, 2023

Canada Child Benefit

- January 20, 2023

- February 20, 2023

- March 20, 2023

- April 20, 2023

- May 19, 2023

- June 20, 2023

- July 20, 2023

- August 18, 2023

- September 20, 2023

- October 20, 2023

- November 20, 2023

- December 13, 2023

Ontario Trillium Benefit

- January 10, 2023

- February 10, 2023

- March 10, 2023

- April 6, 2023

- May 10, 2023

- June 9, 2023

- July 10, 2023

- August 10, 2023

- September 8, 2023

- October 10, 2023

- November 10, 2023

- December 8, 2023

Canada Worker Benefit-Advance Payment

- January 5, 2023

Alberta Child and Family Benefit

- February 27, 2023

- May 26, 2023

- August 25, 2023

- November 27, 2023

Veteran Disability Benefit

- January 30, 2023

- February 27, 2023

- March 30, 2023

- April 27, 2023

- May 30, 2023

- June 29, 2023

- July 28, 2023

- August 30, 2023

- September 28, 2023

- October 30, 2023

- November 29, 2023

- December 21, 2023

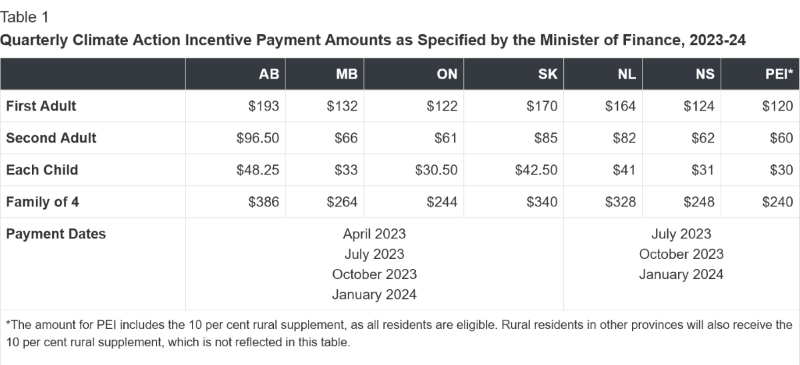

Climate action incentive payment

Basic amount and rural supplement for residents of Alberta, Saskatchewan, Manitoba and Ontario.

- January 13, 2023

- April 14, 2023

- July 14, 2023

- October 13, 2023

Last edited by Ciel21; Sun, Dec 18th, 2022 at 06:23 PM.

"This is the Way." The Mandalorian

-

Sun, Dec 18th, 2022, 07:57 PM #3Easy Glider

- Join Date

- Mar 2017

- Location

- Who knows ... but I Would Rather Be Someone's Shot of Whiskey, Than Everyone's Cup of Tea

- Posts

- 4,033

- Likes Received

- 12166

- Trading Score

- 0 (0%)

Thanks @Ciel21 I have added these dates to my cash flow spreadsheet

-

Sat, Jan 14th, 2023, 08:15 AM #4Frosh Canuck

- Join Date

- Dec 2019

- Location

- SW Ontario

- Posts

- 377

- Likes Received

- 1010

- Trading Score

- 0 (0%)

Climate Action Incentive payment for 2023-24 benefit year begins in April with increased payments and three new provinces (NL, NS, PEI) receiving payments starting in July.

Last edited by eataiag; Sat, Jan 14th, 2023 at 08:16 AM.

-

Thu, Jan 19th, 2023, 12:07 PM #5Frosh Canuck

- Join Date

- Dec 2019

- Location

- SW Ontario

- Posts

- 377

- Likes Received

- 1010

- Trading Score

- 0 (0%)

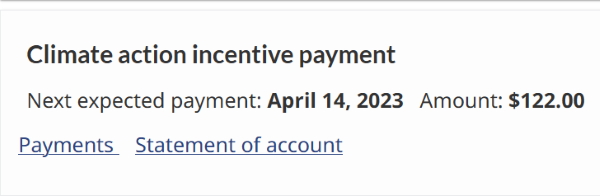

With the income tax filing deadline of April 30 falling after the first Climate Action Incentive payment on April 14, I've wondered how they know who should receive the April payment.

I found the answer under "Filing your income tax and benefit return on paper" which seems like the wrong place to hide it as it applies to everyone.

Looks like if you don't file early (return assessed on or before March 24), you won't get the April payment and will instead receive a double payment in July like last year.

If you are eligible for the climate action incentive payment

The climate action incentive payment (CAIP) is paid quarterly. If you are eligible, you will automatically get the CAIP four times a year. To receive your payment on April 14, 2023, you and your spouse or common-law partner (if applicable), have to file your income tax and benefit returns (even if you did not receive income during the year), and have them assessed on or before March 24, 2023. If your tax returns are assessed after this date, your payment will be included in a subsequent payment after your returns are assessed.

-

Sat, Jan 21st, 2023, 04:35 PM #6Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,288

- Likes Received

- 7354

- Trading Score

- 0 (0%)

@eataiag Good catch on the filing timing to get the April CAI installment! What a situation-Gregorian Easter falls on second week of April, followed by Julian Easter on the next week.

STill waiting for my CRA tax package in the mail-probably arriving in Feb like last year?"This is the Way." The Mandalorian

-

Mon, Feb 6th, 2023, 12:41 PM #7Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,288

- Likes Received

- 7354

- Trading Score

- 0 (0%)

Tax package came in the mail last Wednesday!

Definitely will get going on that return so it goes out this month.

"This is the Way." The Mandalorian

Definitely will get going on that return so it goes out this month.

"This is the Way." The Mandalorian

-

Mon, Feb 20th, 2023, 11:11 AM #8Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

-

Wed, Mar 22nd, 2023, 07:38 AM #9Frosh Canuck

- Join Date

- Dec 2019

- Location

- SW Ontario

- Posts

- 377

- Likes Received

- 1010

- Trading Score

- 0 (0%)

My April CAIP showed up on CRA My Account.

-

Fri, Mar 24th, 2023, 11:31 AM #10Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,288

- Likes Received

- 7354

- Trading Score

- 0 (0%)

I expect to get paper proof of the above in the near future by mail, @eataiag . Can't venture into my account due to the 2-factor id.

"This is the Way." The Mandalorian

-

Fri, Mar 24th, 2023, 07:15 PM #11Frosh Canuck

- Join Date

- Dec 2019

- Location

- SW Ontario

- Posts

- 377

- Likes Received

- 1010

- Trading Score

- 0 (0%)

@Ciel21 I guess you've considered revoking your current user ID and starting fresh by creating a new one with passcode grid for 2FA. I know I can get to "Manage CRA security options" and "Revoke CRA user ID" without going through 2FA. Not sure what are the pitfalls of doing this.

-

Tue, Mar 28th, 2023, 02:42 PM #12Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,288

- Likes Received

- 7354

- Trading Score

- 0 (0%)

@eataiag No I am not revoking my CRA user ID. I simply don't have access to the Internet at home since sibling booted me off by changing the password. I knew it would happen. Since the landline is the only phone I have access to, I'd need to be online to enter that code within 5min or I'd be unable to access My Account. Had no issues last fall whilst I had Internet access on his desktop computer (and I had to hustle up and down stairs to get the code from the answering machine-quite a feat given how much torso pain I have).

"This is the Way." The Mandalorian

-

Thu, Apr 6th, 2023, 06:17 PM #13Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,288

- Likes Received

- 7354

- Trading Score

- 0 (0%)

I forgot to share that my Notice of Assessment arrived on March 28 with an assessment date of March 23! No mention of the CAI payment but I assume the amount will show up on April 14 (will check before I spree).

"This is the Way." The Mandalorian

-

Sun, Apr 9th, 2023, 04:10 AM #14Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

Get your taxes done ASAP since CRA workers strike seems to be on!

https://www.cbc.ca/news/politics/cra...date-1.6805148

You won't get most of the benefits like HST, OTB, CAIP, GIS etc unless your tax return is filed & processed in time!

Most benefits go from July to June.

-

Tue, Apr 11th, 2023, 12:29 PM #15Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,288

- Likes Received

- 7354

- Trading Score

- 0 (0%)

Appreciate that notice @tjthemanto! I just told someone to hustle on that tax return due to strike action being likely. Also, I assume that the CAI payment due out on Friday is set up online ready to go...or some of us will not get any spending done.

Saw a strange technical glitch impeding credits headline related to CRA on a morning show today.

Found this debt recovery item on CRA site: https://www.canada.ca/en/revenue-age...-payments.htmlLast edited by Ciel21; Tue, Apr 11th, 2023 at 02:04 PM.

"This is the Way." The Mandalorian

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

73Likes

73Likes

Send PM

Send PM