User Tag List

Results 1 to 15 of 19

-

Mon, Feb 20th, 2023, 11:04 AM #1Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

For doing 2022 tax year taxes, CRA opened their NETFILE today on Monday, February 20, 2023.

I would advise you to do your taxes early as CRA workers and other federal government workers might go on a strike in April this year. ( Hopefully they don't )

My Timeline this year:

Netfiled : February 20, 2023.

Notice of Assessment: March 2, 2023.

Was immediately assessed in minutes after Netfiling on the same day. Express NOA was also available immediately on the same day.

Full detailed NOA available on March 2, 2023.This thread is currently associated with: N/A

-

-

Mon, Feb 20th, 2023, 11:08 AM #2Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

-

Tue, Feb 21st, 2023, 08:21 AM #3no more door to door! :)

- Join Date

- Jul 2010

- Location

- Scarlem

- Posts

- 42,596

- Likes Received

- 74385

- Trading Score

- 24 (100%)

excellent reminder and thread! ty @tjthemanto

babies teach us acceptance

-

Tue, Feb 21st, 2023, 08:12 PM #4Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

Thanks OP.

The CRA website has free versions of income tax programs. Noticed they changed who can use the free versions, so not as many people as before COVID.

Any suggestions about getting a cheaper version of the free versions?

Thanks in advance.

-

Tue, Feb 21st, 2023, 10:01 PM #5Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

Wealthsimple Tax is still free to use for all income group.

https://www.wealthsimple.com/en-ca/tax

Very easy & simple to use. I used it to do taxes of someone else.

UFile & Turbo Tax ( formerly Quick Tax ) are getting too greedy and only some people and income group can use it for free, rest you have to pay.

-

Wed, Feb 22nd, 2023, 10:17 AM #6Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,311

- Likes Received

- 7395

- Trading Score

- 0 (0%)

The Toronto Star mentioned that the PSAC union will be holding strike votes from this month into April. Included are tax season workers.

Also there was an article about a person who wanted to learn how to do his own taxes after using an accountant one year for tax preparation. The person realized he missed out on a work from home credit and also commented how he could not find all of the information he needed. But he's still keen to encourage other Canadians to learn about doing their own tax returns.

https://www.thestar.com/business/per...d-to-know.html"This is the Way." The Mandalorian

-

Wed, Feb 22nd, 2023, 02:39 PM #7Mastermind

- Join Date

- Dec 2010

- Location

- Ontario

- Posts

- 24,160

- Likes Received

- 40644

- Trading Score

- 7 (100%)

-

Thu, Mar 9th, 2023, 03:35 PM #8Frosh Canuck

- Join Date

- Dec 2019

- Location

- SW Ontario

- Posts

- 377

- Likes Received

- 1010

- Trading Score

- 0 (0%)

Just netfiled today, March 9. Notice of assessment will be dated March 20.

Getting close (4 days) to the April Climate Action Incentive payment cutoff of March 24.

-

Tue, Mar 14th, 2023, 01:32 PM #9Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,311

- Likes Received

- 7395

- Trading Score

- 0 (0%)

I did the snail mail income tax return. Now to wait and see if I get a Notice of Assessment at end of March or first week of April to state whether I got in under the March 24 cutoff date or not for the April CAI payment (shoes or spring jacket budget money).

Can't use my CRA account due to the 2-factor notification because I don't have Internet access at home for over two months now."This is the Way." The Mandalorian

-

Wed, Mar 15th, 2023, 06:30 AM #10Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

They have a passcode grid which you download in a PDF format on your computer, mobile phone or print it.

You can use it for 2-Factor notification for CRA login.

So no need for SMS notification or voice call on the phone with the code for login.

Whenever I am out of the country, I use the passcode grid for login into My Account for 2 - Factor notification.

-

Wed, Mar 15th, 2023, 02:46 PM #11Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,311

- Likes Received

- 7395

- Trading Score

- 0 (0%)

@tjthemanto Can't use the grid as I have no tech of my own anymore and I'm booted off of sibling's desktop.

But--I see two e-mails in my account from CRA (I have not disclosed it to them for ongoing communications, just when I signed up for the My Account creation)-my return was "received" just after midnight today and as of 8 something am, it's in progress of being assessed.

Since @eataig mentioned a 11-day later NOA for her return, I guess my NOA will be dated after March 24, so March 26. I seriously hope that is not the case. Can't log into My Account so wait and see. At least I know the return is open at their end. "This is the Way." The Mandalorian

"This is the Way." The Mandalorian

-

Tue, Mar 21st, 2023, 09:25 PM #12Frosh Canuck

- Join Date

- Dec 2019

- Location

- SW Ontario

- Posts

- 377

- Likes Received

- 1010

- Trading Score

- 0 (0%)

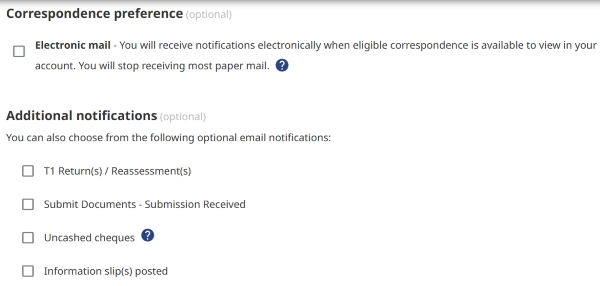

I received just one e-mail after Netfile saying my return is "currently processing". I also haven't given them my e-mail address to go paperless. When I went online to "Notification preferences" I saw what's shown in the image below. Only the "T1 Returns/Reassessment(s)" box was checked even though I don't remember checking it myself. I think that was the option that caused the e-mail after filing.

-

Sun, Apr 9th, 2023, 04:04 AM #13Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

Looks like the CRA workers strike is on. Legal strike position since April 14.

Try to get your taxes done ASAP !

https://www.cbc.ca/news/politics/cra...date-1.6805148

-

Tue, Apr 18th, 2023, 09:57 AM #14Smart Canuck

- Join Date

- Dec 2008

- Location

- Alberta

- Posts

- 4,670

- Likes Received

- 11330

- Trading Score

- 124 (100%)

anyone remembers how long you get the refund (direct deposit) after you receive your full detailed NOA (not the express NOA that you get immediately after netfile)?

-

Tue, Apr 18th, 2023, 10:01 AM #15Smart Canuck

- Join Date

- Dec 2008

- Location

- Alberta

- Posts

- 4,670

- Likes Received

- 11330

- Trading Score

- 124 (100%)

sorry I found my answer by logging into my cra account and it says the date that i will get a direct deposit.

Last edited by Purdee; Tue, Apr 18th, 2023 at 10:14 AM.

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

43Likes

43Likes

Send PM

Send PM