User Tag List

Results 1 to 7 of 7

-

Fri, Jan 12th, 2024, 01:28 PM #1Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,321

- Likes Received

- 7409

- Trading Score

- 0 (0%)

Expires on: Tue, Dec 31st, 2024Apologies to anyone (who like me) might have been expecting to get the January Climate Action Incentive Payment today. At least I checked my account at the ATM on the way!

The schedule indicates the payment is on the 15th of January, April, July and October unless the day falls on the weekend or federal statutory holiday-then payment is made on the last business day before the 15th.

Climate Action Incentive

https://www.canada.ca/en/revenue-age...-payments.html

Benefit payment dates

Canada child benefit (CCB)

Includes related provincial and territorial programs

All payment* dates- January 19, 2024

- February 20, 2024

- March 20, 2024

- April 19, 2024

- May 17, 2024

- June 20, 2024

- July 19, 2024

- August 20, 2024

- September 20, 2024

- October 18, 2024

- November 20, 2024

- December 13, 2024

* Haven't received your payment?

Wait 5 working days from the payment date to contact us.

Goods and services tax / harmonized sales tax (GST/HST) credit

Includes related provincial and territorial programs

All payment* dates- January 5, 2024

- April 5, 2024

- July 5, 2024

- October 4, 2024

* Haven't received your payment?

Wait 10 working days from the payment date to contact us.

Ontario trillium benefit (OTB)

Includes Ontario energy and property tax credit (OEPTC), Northern Ontario energy credit (NOEC) and Ontario sales tax credit (OSTC)

All payment* dates- January 10, 2024

- February 9, 2024

- March 8, 2024

- April 10, 2024

- May 10, 2024

- June 10, 2024

- July 10, 2024

- August 9, 2024

- September 10, 2024

- October 10, 2024

- November 8, 2024

- December 10, 2024

* Haven't received your payment?

Wait 10 working days from the payment date to contact us.

Climate action incentive payment (CAIP)

All payment* dates- January 15, 2024

- April 15, 2024

- July 15, 2024

- October 15, 2024

* Haven't received your payment?

Wait 10 working days from the payment date to contact us.

Advanced Canada workers benefit (ACWB)

All payment* dates- January 12, 2024

- July 12, 2024

- October 11, 2024

* Haven't received your payment?

Wait 10 working days from the payment date to contact us.

Alberta child and family benefit (ACFB)

All payment* dates- February 27, 2024

- May 27, 2024

- August 27, 2024

- November 27, 2024

* Haven't received your payment?

Wait 5 working days from the payment date to contact us.

https://www.canada.ca/en/revenue-age...ent-dates.htmlThis thread is currently associated with: N/A"This is the Way." The Mandalorian

-

-

Tue, Jan 30th, 2024, 10:14 PM #2Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

-

Fri, Feb 16th, 2024, 09:40 AM #3Frosh Canuck

- Join Date

- Dec 2019

- Location

- SW Ontario

- Posts

- 377

- Likes Received

- 1010

- Trading Score

- 0 (0%)

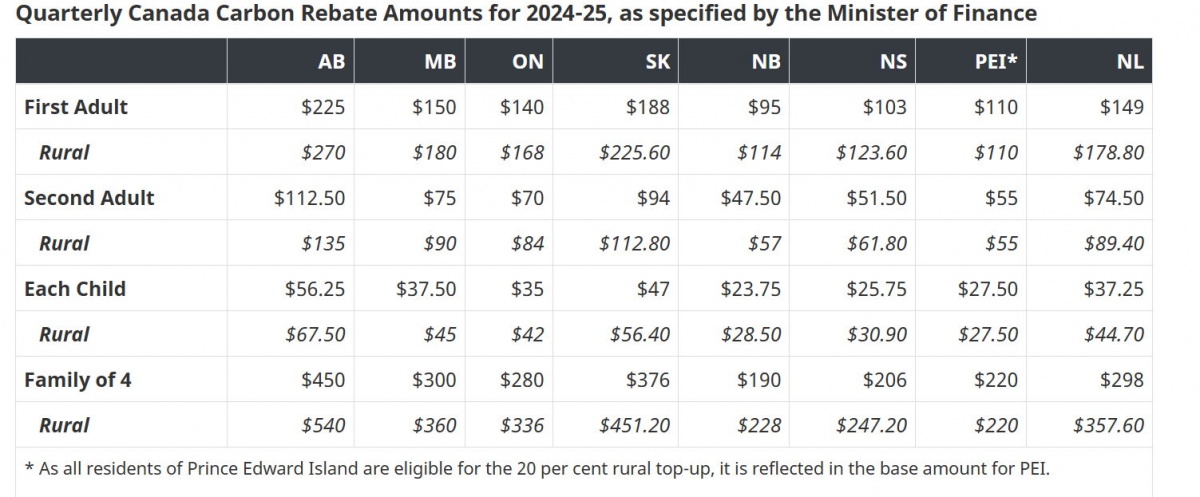

Amounts for the Canada Carbon Rebate (CCR) (previously known as the Climate Action Incentive Payment) new benefit year starting in April 2024 announced: https://www.canada.ca/en/department-...r-2024-25.html

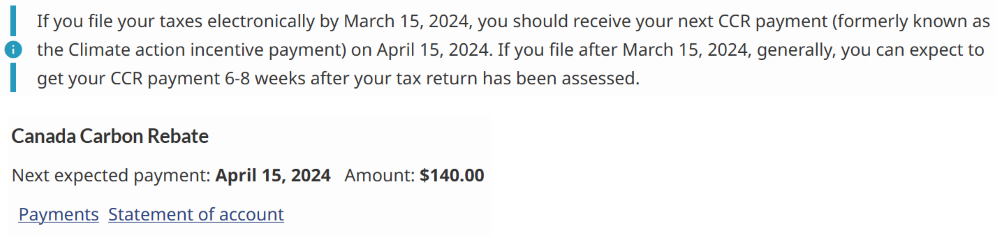

https://www.canada.ca/en/revenue-age...-payments.htmlTo receive your payment on April 15, 2024, you and your spouse or common-law partner (if applicable), must have your income tax and benefit return filed electronically on or before March 15, 2024. If your tax returns are processed after this date, your payment will be included in a subsequent payment after your return is assessed.

Last edited by eataiag; Fri, Feb 16th, 2024 at 10:20 AM.

-

Fri, Mar 1st, 2024, 07:28 PM #4Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,321

- Likes Received

- 7409

- Trading Score

- 0 (0%)

So $18 increase for me in Ontario. If I remember 2023, those of us who had returns assessed by March 23 last year got the CAI one week prior to the rest of the filers? It was not much of a difference but CRA must like the carrot approach to get people to file while they have seasonal staff on duty for tax time.

"This is the Way." The Mandalorian

-

Sat, Mar 9th, 2024, 08:14 PM #5Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,321

- Likes Received

- 7409

- Trading Score

- 0 (0%)

Saskatchwan residents, you have to watch and see how long your Premier and the Federal Government argue over carbon tax remittances as your Canada carbon rebate cheques are not coming.

https://www.msn.com/en-ca/news/canad...te/ar-BB1ji9MG"This is the Way." The Mandalorian

-

Thu, Mar 28th, 2024, 01:24 PM #6Frosh Canuck

- Join Date

- Dec 2019

- Location

- SW Ontario

- Posts

- 377

- Likes Received

- 1010

- Trading Score

- 0 (0%)

My Account shows my April CCR payment now. They also clarified the meaning of "subsequent payment" if you filed after March 15.

-

Sat, Mar 30th, 2024, 01:09 PM #7Smart Canuck

- Join Date

- May 2021

- Location

- Ancaster ON

- Posts

- 4,321

- Likes Received

- 7409

- Trading Score

- 0 (0%)

Darn, guess there's no spree on April 15 for me. Since it takes about 4 weeks to get a paper tax return to assessment, that means the CCR might not reach me until June! I dislike the yearly moving of the carrot stick in relation to the CCR.

Feel for the residents of Saskatchewan-no CCR for anyone whilst the Premier withholds carbon tax funds from the federal government."This is the Way." The Mandalorian

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

6Likes

6Likes

Send PM

Send PM