User Tag List

Results 1 to 15 of 158

-

Fri, Feb 7th, 2014, 12:48 AM #1Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

How & When did you file your taxes ?

1. Used Tax Software like UFILE , TURBO TAX, STUDIO TAX etc & NETFILED ,

2. Paper/Forms & Mailed by Canada Post or Dropped it in a CRA drop box ,

3. Used a tax professional/clinic like H & R block etc

What was you timeline from Start to Finish ? See mine below from last year

---------

Wow ..That was fast

March 1 ( Sat ) : Netfiled My Return using Turbo Tax at 9.30 pm

March 4 ( Tue ) : Showing Assessed Online

March 10 ( Mon ) : Will be Directly Deposited in my bank account

Same amount as I calculated , so happy

-----

This is the timeline for another year when I physically mailed my return

For those who did a paper return ( not NETFILE or TELEFILE ) and mailed it in , like me , here is my time line...from some previous year

Feb 13 : Mailed my Tax Return by Canada Post ( cost me 2 stamps )

Feb 29 : Showing Received in my CRA- My Account

March 7 : Showing Assessed in my CRA -My Account

March 15 : Refund to be Direct Deposited in my bank Account This thread is currently associated with: Canada Post

This thread is currently associated with: Canada Post

-

-

Fri, Feb 7th, 2014, 08:42 AM #2Smart Canuck

- Join Date

- Dec 2009

- Location

- Calgary

- Posts

- 3,737

- Likes Received

- 19636

- Trading Score

- 1 (100%)

We have done a preliminary run through on the tax program and will be getting a refund. However need to wait somewhat longer for T5's etc to arrive.

-

Fri, Feb 7th, 2014, 10:44 AM #3Canadian Guru

- Join Date

- Jan 2009

- Location

- Halifax, NS

- Posts

- 10,451

- Likes Received

- 6365

- Trading Score

- 61 (100%)

Mine won't show up until the end of February. We normally get a decent refund though.

-

Fri, Feb 7th, 2014, 10:45 AM #4Must Coupon, Must Save :)

- Join Date

- Nov 2012

- Age

- 40

- Posts

- 10,105

- Likes Received

- 42817

- Trading Score

- 64 (100%)

The only thing I have so far is my T4 still waiting on everything else so think it will still be a bit of a wait for me.

2022 is going to be my year, the year I find organization in my life and the year I focus on myself,

follow along as tackle day to day life and whatever else 2021 throws at me:

https://www.instagram.com/thelife.ofsassy

-

Mon, Feb 10th, 2014, 03:31 PM #5Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

-

Mon, Feb 10th, 2014, 08:47 PM #6Bean bun going offline

- Join Date

- Jul 2009

- Location

- Ontario

- Posts

- 17,846

- Likes Received

- 24776

- Trading Score

- 12 (100%)

Plan to file my paper return this week. Already got my forms from Shoppers yesterday.

Everyone's annual favourite site at this time of year:

http://www.cra-arc.gc.ca/menu-eng.htmlLast edited by Ciel; Mon, Feb 10th, 2014 at 08:52 PM.

2021-Bring on the sunshine, sweets & online shopping.

-

Tue, Feb 11th, 2014, 03:06 PM #7

I usually get it done in early April.

-

Tue, Feb 11th, 2014, 03:40 PM #8Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

Don't forget this year the envelope is seperate .. so you have to pick it up from another bin ..its not included inside the forms booklet like previous year.

Its weird , I also do a paper return ..the old fashioned way ..no software for me

..no software for me  ..and drop it at a CRA drop box close to me , so no postage for me either

..and drop it at a CRA drop box close to me , so no postage for me either

-

Tue, Feb 11th, 2014, 04:44 PM #9Awake.

- Join Date

- Oct 2008

- Location

- Ontario

- Age

- 44

- Posts

- 5,034

- Likes Received

- 3673

- Trading Score

- 99 (100%)

I wanted to file with Turbo tax but I didn't see the normal "free" option available. Also....I forget, if I want to E-File, do I get a new code every year? Oh my annoying brain lol

-

Tue, Feb 11th, 2014, 06:11 PM #10Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

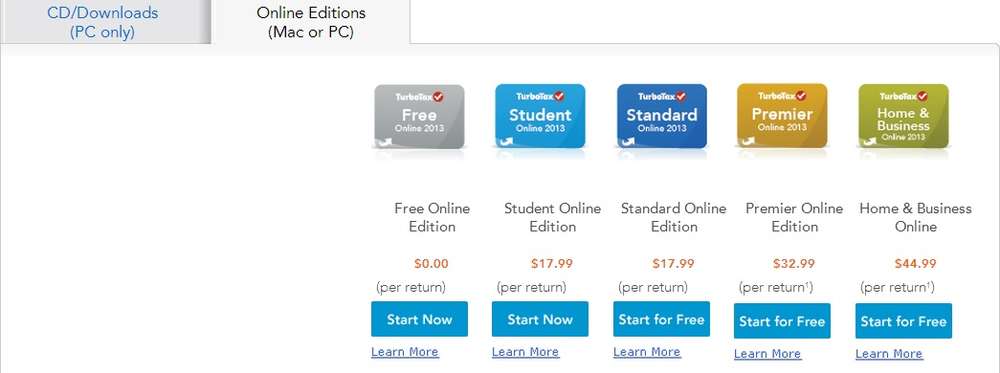

I don't think Turbo tax has Free return this yr.

See table below.

Studio Tax is Free for everyone.

Other tax programs depending on income level is free software filing for some people and not for others.

Ofcourse the Netfiling from CRA is free for everyone, no charges for that..I am talking of the software charges.

http://www.netfile.gc.ca/sftwr-eng.html

Desktop products Free offerings More details StudioTax 2013 Free for everyone More details FutureTax 2013 Free offerings available More details myTaxExpress 2013 Free offerings available More details UFile for Windows Free offerings available More details TaxFreeway for Windows Free offerings available More details TaxTron for Windows Free offerings available More details TurboTax N/A More details Online products Free offerings More details AdvTax Free for everyone More details SimpleTax Free for everyone More details WebTax4U.ca Free offerings available More details Tax Chopper Online Free offerings available More details EachTax.com Free offerings available More details

Access Code is NO longer required to NETFILE , so don't worry about that

http://support.intuit.ca/turbotax/en.../INF15032.html

http://canadaonline.about.com/od/per...ccess-code.htm

-

Tue, Feb 11th, 2014, 08:54 PM #11Awake.

- Join Date

- Oct 2008

- Location

- Ontario

- Age

- 44

- Posts

- 5,034

- Likes Received

- 3673

- Trading Score

- 99 (100%)

Thank you tjthemanto, I forgot about he code. Wasn't last year the first year we didn't need it? I did poke around Turbo Tax and you can do it for free this year for one return. This is what they offer there.

-

Tue, Feb 11th, 2014, 09:14 PM #12Bean bun going offline

- Join Date

- Jul 2009

- Location

- Ontario

- Posts

- 17,846

- Likes Received

- 24776

- Trading Score

- 12 (100%)

I mailed in my basic return. Noticed these things:

1) envelopes for Hamilton this year are addressed to Summerside PEI CRA Tax Centre! Which is as they should be-Hamilton returns go to PEI. Last year, the generic Sudbury Tax Centre address was on the envelopes (Sudbury is where Toronto returns are sent). Envelopes are in a slot on side of Forms box. If slot is empty, ask Postal Office staff for a refill.

2) Form ON-BEN: the 2014 Ontario Trillium Benefit form-there is a box 6109-read what it says in the guide for that part before checking it.

If your family is getting more than $360 in OTB for the July 2014-June 2014 year, by checking this box you are agreeing to a lump sum payment in July 2015. Why is Ontario making families/individuals wait a year for the lump sum if people want one payment? Is this what Premier Wynne meant by letting taxpayers make an election on the 2013 tax returns? Otherwise DO NOT CHECK THE BOX and you'll see your monthly sum every month starting in July 2014.

For families/individuals receiving less than $360 for the OTB, the lump sum will be paid in July 2014.

http://www.cra-arc.gc.ca/E/pbg/tf/5006-tg/README.html

* have income on line 104? Make sure you claim an amount on line 363 on Schedule 1 for employment amount.

*if your working income is over $3000 and you are lower income, you may be able to claim something on line 453 Working income tax amount (Schedule 6).Last edited by Ciel; Tue, Feb 11th, 2014 at 09:15 PM.

2021-Bring on the sunshine, sweets & online shopping.

-

Tue, Feb 11th, 2014, 09:20 PM #13Awake.

- Join Date

- Oct 2008

- Location

- Ontario

- Age

- 44

- Posts

- 5,034

- Likes Received

- 3673

- Trading Score

- 99 (100%)

Ciel GOOD point on the lump sum for OTB. I read over that to my mom about 20 times and she finally said to me, "that's going to screw a lot of people up. Maybe they are hoping you die before they have to pay the lump sum out." lol It's so stupid.

-

Tue, Feb 11th, 2014, 09:43 PM #14Canadian Genius

- Join Date

- Mar 2010

- Location

- ON

- Posts

- 6,071

- Likes Received

- 13059

- Trading Score

- 51 (100%)

.

Last edited by lecale; Tue, Feb 18th, 2014 at 08:18 AM.

-

Tue, Feb 11th, 2014, 10:13 PM #15Canadian Guru

- Join Date

- Mar 2010

- Location

- Canada

- Posts

- 11,052

- Likes Received

- 6201

- Trading Score

- 46 (100%)

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

145Likes

145Likes

Send PM

Send PM

..all other slips are in

..all other slips are in  60,000

60,000  75,000

75,000