User Tag List

Results 16 to 30 of 59

-

Sat, Apr 9th, 2011, 01:11 PM #16Financial Advisor

- Join Date

- Mar 2010

- Location

- GTA

- Posts

- 1,207

- Likes Received

- 128

- Trading Score

- 0 (0%)

A Picture Is Worth 1,000 Words

See the total US 2011 Total Budget spending : Projected Revenue (money collected) vs Deficit (money shortfall). they are spending 43.1% more money than they can collect. Now where does this deficit money comes from.... By selling US Treasury (debts/bonds) to investors & foreigners (Japanese/Chinese/etc). Recently demand for US debts has reduced significantly, so to offset the loss, Federal Reserve is printing money & buying their own debt's (called Quantitative easing). This is the most destructive experiment of money creation....which leads to inflation & possibly hyperinflation.

Both Democrats/Republicans are recommending negligible cuts 0.86% vs 1.59%.. they are both addicted to spending.

Net result is, a lot of money will be printed in the near future.. which will devalue the currency... & that is why getting out of currency into ..............whatever you fell as store of value is an ideal way to go...Last edited by ashedfc; Sat, Apr 9th, 2011 at 01:25 PM.

-

-

Sat, Apr 9th, 2011, 02:56 PM #17CaLoonie

- Join Date

- Mar 2011

- Location

- Niagara Region

- Posts

- 127

- Likes Received

- 0

- Trading Score

- 1 (100%)

Thank you Ashedfc. I appreciate the clarification.

Can you explain to me, as the US dollar depreciates, how does that effect the value of the Cnd dollar? I'm wondering if Canadian money markets are considered "safe" as a temporary parking space from the market.De

-

Sat, Apr 9th, 2011, 03:35 PM #18

i'm not sure but as US is our biggest client,

IMO if us dollar drops their importations will also drop and as the main CND exportations depend on them ...then will follow our $....this is one of the reason why our governements are looking on other directions i.e. Europe, Asian and Middle-East ....(China as well as India are a big market in development)

sorry i aswered instead of OP.....but in the mean time i'd like see if i'm OK with my deductions....

-

Tue, Apr 12th, 2011, 01:51 PM #19

http://www.theprovince.com/news/bc/s...052/story.html

Very important to remember that "loose lips sink ships", even today. Apparently he wasn't tight-lipped enough about what he had in his house.Always looking for reasonably healthy food coupons, non-dairy products, and friendly cleaners (esp Method brand).

-

Tue, Apr 12th, 2011, 02:07 PM #20Financial Advisor

- Join Date

- Mar 2010

- Location

- GTA

- Posts

- 1,207

- Likes Received

- 128

- Trading Score

- 0 (0%)

This is why I prefer the electronic format, with a physical delivery option. Like PSLV (Sprott Physical Silver), or PHYS (Sprott Physical Gold) where one can take delivery of physical bullion if you want to take possession. Its easy liquidity & guaranteed physical allocated backing (not just a promise)..

WHEN ELEPHANTS FLY, IT WILL BE TOO LATE TO BUY

Source: Darryl Robert Schoon http://www.321gold.com/editorials/sc...oon041211.htmlLast edited by ashedfc; Tue, Apr 12th, 2011 at 02:56 PM.

-

Wed, Apr 13th, 2011, 04:15 PM #21Financial Advisor

- Join Date

- Mar 2010

- Location

- GTA

- Posts

- 1,207

- Likes Received

- 128

- Trading Score

- 0 (0%)

Keep in mind that US Dollar is the world reserve currency, so the implications of USD devaluation will be far more than one can imagine....... as it will affect different asset class differently..

1. Currency: All currencies will go down with it, those countries who have who have their finances in order will do well, creditor nation currency will do well, resource based currency will also do well in comparison to the USD, & Canadian dollar fits in this category.. Bonds/Money market/GIC/cash represent the underlying currency. This becomes the biggest loser, but keep in mind, if a bout of deflation comes preserving wealth is very important. Like it happened in 1920 in Germany, where they had a phase of deflation in the middle of a hyperinflation which collapsed their currency in 1923.

2. Commodities: More money chasing few goods increases their price, so, it feels like gas has become expensive (infact its money becoming cheaper)

3. Real-estate & Farm Land: This is expected to do well, as money moves to hard assets to protect value. House prices have already gone up in Canada, Australia, China, India, Brazil, etc..

4. Equities: They normally do well in an inflationary environment, example, recently the world's best performing stock exchange was Zimbabwe, but when you measure their inflation adjusted numbers actually they lost money..

5. Precious metals: Gold/Silver is the best asset class, as they preserve value & grow the most in a currency devaluation or currency collapse environment..

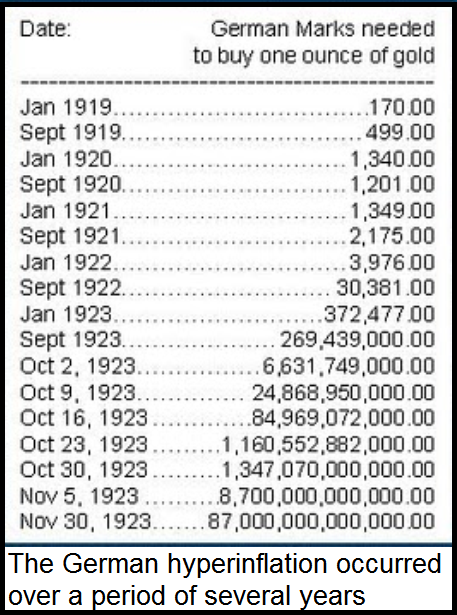

Germany is the best example we can get & learn from, I have attached this chart, so one can look at the value of Gold in their currency during hyperinflation.

(in Jan 1919, 170RM would buy 1oz Gold, & in 1920 they had mild deflation & thereafter from 1921 it went crazy that in 1923 it went astronomical/parabolic/mind boggling)

This is what can happen again this time. Even if we see a few % of this, it can wipe out a lot of wealth from people who are unprepared..Last edited by ashedfc; Wed, Apr 13th, 2011 at 04:29 PM.

-

Fri, Apr 15th, 2011, 09:53 AM #22

so, what do you suggest us to do ?

is having a good stockpile of stuff gotten for free or almost that covers many of our needs for some months can help ?

should we start buying gold ? even at the high price it is now ? and what if we buy it at this rate and the value drops ?

what else ?

-

Fri, Apr 15th, 2011, 03:41 PM #23

-

Fri, Apr 15th, 2011, 04:34 PM #24Financial Advisor

- Join Date

- Mar 2010

- Location

- GTA

- Posts

- 1,207

- Likes Received

- 128

- Trading Score

- 0 (0%)

I know it feels like that..... True.

But, just for a second, if the worst happens than only those who are prepared will do well. It has happened in the past: Germany, Yugoslavia, Italy, Hungary, Argentina, etc. they have seen hyperinflation & currency devaluation.... this time it doesn't looks impossible. And Gold hit another All-time-HIGH today.. on concerns of US debt ceiling & Belarus..

Another very important development:- "Failure by Congress to raise the U.S. debt limit "could plunge the world economy back into recession" President Barack Obama declared Friday

Anyway watch this & enjoy your weekend........ be prepared.

<object style="height: 390px; width: 640px"><param name="movie" value="http://www.youtube.com/v/iDmJcDvaBGU?version=3"><param name="allowFullScreen" value="true"><param name="allowScriptAccess" value="always"><embed src="http://www.youtube.com/v/iDmJcDvaBGU?version=3" type="application/x-shockwave-flash" allowfullscreen="true" allowScriptAccess="always" width="640" height="390"></object>Last edited by ashedfc; Fri, Apr 15th, 2011 at 05:37 PM.

-

Fri, Apr 15th, 2011, 04:46 PM #25

-

Fri, Apr 15th, 2011, 09:46 PM #26Canadian Genius

- Join Date

- Jun 2009

- Location

- Alberta, Canada

- Posts

- 7,333

- Likes Received

- 225

- Trading Score

- 118 (100%)

At this point, I try not to read TOO much about it all. I want to be in the know and get the jist of it all, but I don't want to be worrying and stressing.

In the big picture I feel very good. There are little things here and there that have a little "ahh"... but I still feel okay. Fortunetly for me with some.. unfortunate happenings, I have a year's worth of my yearly income in the bank (and it keeps adding up, slowly)... compiling interest as we speak. If something happens to the actual banking system... then I am screwed, haha. I also got a house out of the ordeal... a mortgage that is less than what most have... but that's all I got... and my stockpile! HEHEHEHE!

-

Fri, Apr 15th, 2011, 11:57 PM #27

Theres no point in living in fear or thinking that all these things may or may not happen. Seriously. Why not enjoy your life instead of worrying of the unknown.

-

Sat, Apr 16th, 2011, 08:13 PM #28

Yes, in this crisis gold and silver will rock!

However, theres a chance we'll have a second "market bust" once they stop the stimulus.

That means housing correction for us in Canada...

But silver is a great way to invest for average folks like me : )

its $ 40 an ounce, you can easily buy couple a month...I think its a great start.

What do you think?Dan S.

"Providing Debt Solutions That Work!"

Consumer Proposal Bankruptcy Debt Settlement Home Refinancing

-

Sun, Apr 17th, 2011, 10:11 AM #29Financial Advisor

- Join Date

- Mar 2010

- Location

- GTA

- Posts

- 1,207

- Likes Received

- 128

- Trading Score

- 0 (0%)

I can only give my opinion. As far as how much of inflation hedge to buy & in what form is an individual's personal discretion & every individuals finances are different from each other, so one suggestion doesn't fits all.

As a rule of thumb "All those who have any kind of inflation hedge assets in their portfolio will do very well, once this mess is cleared in a couple of years".... Most of us, have all their wealth tied in real estate, by virtue of home ownership, that itself is a kind of kind of inflation hedge, but problem is if (not if/ but when) interest rates all-over shoots up, as bond vigilantes dictate the bond markets in higher interest, like in Greece, where Govt. of Greece is forced to pay 16% interest for 2yr bond (Guys Govt of Greece is an excellent case, their borrowing rate is like a credit card).

Gold is expensive, not yet (its still affordable), very soon it won't be.

Silver is called poor man's gold, because of its lower price..

So, keep accumulating as much as you can, if price goes down than buy more; as this financial mess is far from over, infact the second round of recession is just around the corner. Japan nuclear disaster/Middle east crisis taking oil price higher/US debt ceiling limit increase & subsequent dollar printing/ Eurozone PIIGS debt crisis contagion, each one is a major case in its own, & now we have all of them pointing towards higher Gold/Silver prices..

Texas university pension fund just bought 1billion $ worth of Gold (yes Gold in physical bars), their is a reason why its happened. http://ashedfc.blogspot.com/2011/04/...n-in-gold.html

Again I repeat "Smart money moves first; & the dumb money moves later" When everyone starts talking about Silver "like Nortel stock" than its the time to get out, till than keep accumulating, I assure you, "you won't regret"Last edited by ashedfc; Sun, Apr 17th, 2011 at 11:00 AM.

-

Tue, Apr 19th, 2011, 02:16 PM #30Financial Advisor

- Join Date

- Mar 2010

- Location

- GTA

- Posts

- 1,207

- Likes Received

- 128

- Trading Score

- 0 (0%)

Here is the proof "Its not fear mongering" there is substantial fact in the statement: http://truth11.com/2011/04/13/china-...-is-beginning/

And look at US Dollar its already collapsing; S&P has Put US on Negative watch; Gold hit $1500 per oz, its all time high; these are not normal times, only those who are prepared will survive this economic disaster unfolding...

20 Signs of Economic Decline in America http://www.businessinsider.com/24-si...ca-2011-4?op=1Last edited by ashedfc; Fri, Apr 22nd, 2011 at 03:12 PM.

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Send PM

Send PM